NPF, the minimum rate is 3% payable from our salary (limit Rs 15,710) i.e. we are the “employee”. Our bosses pay 6% of the salary (once again, limit of Rs 15,710).

As for NFS (National Savings Fund), the rate is 1% from us and 2.5% from the bosses.

Let’s say you earn Rs 10,000 as salary.

NPF payable by YOU : 3% of Rs 10,000 = Rs 300 🙁

NPS payable by YOU : 1% of Rs 10,000 = Rs 100 :'(

NPF payable by boss: 6% of Rs 10,000 = Rs 600 (meh)

NFS payable by boss: 2.5% of Rs 10,000 = Rs 250 (meh, don’t care)

Total NPF + NFS: Rs 1250.

However, if you earn more than Rs 15,710, the NPF and NFS is calculated only on Rs 15,710:

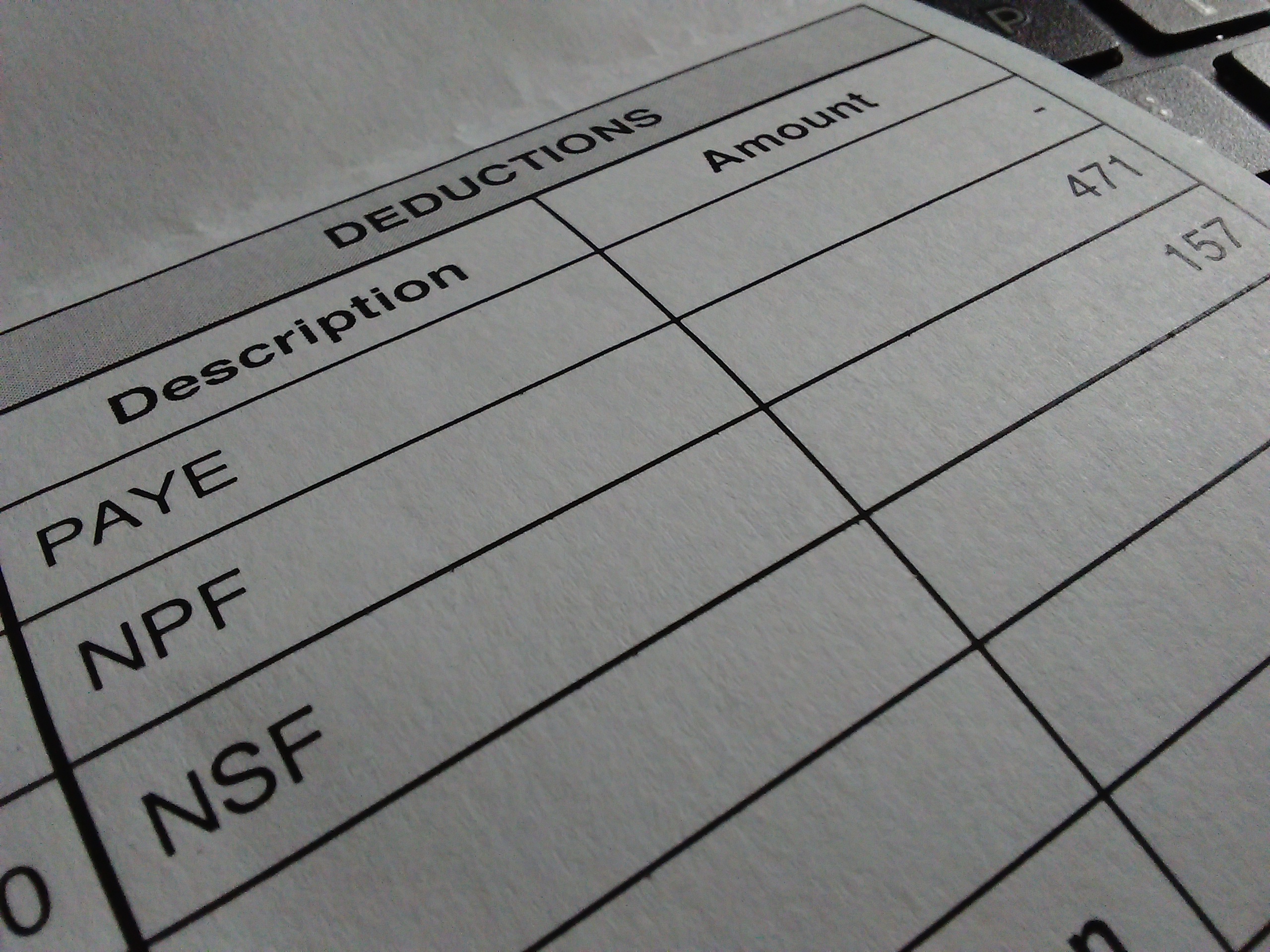

NPF payable by YOU : 3% of Rs 15,710 = Rs 471 🙁

NSF payable by YOU : 1% of Rs 15,710 = Rs 157 :'(

NPF payable by boss: 6% of Rs 15,710 = Rs 943 (who cares)

NSF payable by boss: 2.5% of Rs 15,710 = Rs 393 :'(

Total NPF + NSF: Rs 1,964

Here’s a graph of the NPF and NFS paid as per monthly salaries.

I can’t really understand the logic between NPF/NSF paid by me (employee) and NPF/NSF paid by my employer (boss). Where do our bosses get money from? They make us work for it!

We work for our bosses to be able to:

– pay our travel allowances

– pay for company air-conditioners

– pay for company computers

– pay for company furniture

– pay for company coffees

All these come from our sweat. Else the company would be running on losses. Is it really our bosses paying the extra 8.5% of the NPF and NFS?

I work for my employer to be able to give Rs 1,335 to the government on top of what is deducted already! Why not be frank and just cut the 12.5% from the salary and write it on my payslip? You too scared of “transparency” Mr The Government?

Ref: [1]